Antisense is pleased to announce that they have received a positive opinion from the EMA Paediatric Committee (PDCO) on the Paediatric Investigation Plan (PIP) which includes their planned European Phase IIb/III clinical trial in non-ambulatory DMD boys.

Read additional details on the planned study and more updates below, as they move ATL1102 into this next stage of development and realizing the potential of this therapy to significantly improve the lives of boys with Duchenne’s and their families.

Positive Opinion received on ATL1102 Paediatric Investigation Plan

&

Successful capital raising to support Phase IIb/III EU clinical trial

• Positive Opinion on PIP, a major achievement on the way to trial commencement

• Successful capital raising with funding pathway to Phase IIb/III trial results

Antisense Therapeutics Limited [ASX: ANP | US OTC: ATHJY | FSE: AWY] (the Company) today announced that the Paediatric Committee (PDCO) of the European Medicines Agency (EMA) adopted a positive final Opinion on its Paediatric Investigation Plan (PIP) for the development of ATL1102 for Duchenne muscular dystrophy (DMD) following the PDCO meeting on 15 October 2021, with EMA ratification to follow.

A PIP is a development plan aimed at ensuring that the necessary data is obtained through studies in children. Approval of the PIP is required to support the authorisation of a medicine for children in the European Union (EU). The PIP addresses the entire paediatric development program for ATL1102 in DMD (including future ambulant DMD patient studies). The positive final opinion from PDCO ensures that the Company’s planned clinical studies including its Phase IIb/III clinical trial of ATL1102 in non-ambulant DMD boys in Europe, will be run in accordance with PDCO expectations for future product approval.

Following receipt of this news, the Company has received firm commitments in an oversubscribed institutional placement to raise A$20.0 million via an issue of approximately 83.3 million new fully paid ordinary shares (New Shares) at $0.24 per share (Placement). The Placement was strongly supported by existing shareholders, with the Company also welcoming a number of new institutional investors to the share register. The Company also intends to conduct a non-underwritten 1 for 9.4 Entitlement Offer targeting to raise A$16.8 million at the same price as the Placement.

Phase IIb/III trial

The Phase IIb/III clinical trial is a multicentre, randomised, double-blind, placebo-controlled study to determine the efficacy, safety, and pharmacokinetic profile of ATL1102 (25 mg and 50 mg) administered once weekly by subcutaneous injection for 52 weeks in non-ambulatory participants with DMD, to be conducted as a potentially pivotal (approvable) trial with a follow-on open label extension trial. Participants will be randomised to either 25 mg ATL1102, 50 mg ATL1102 or placebo in a 1:1:1 ratio with stratification by corticosteroid use. Up to 114 participants are to be enrolled (38 per treatment arm) with 108 participants expected to complete the trial. Additional trial details and timelines are outlined in the investor presentation lodged today with the ASX.

As previously announced, ANP has appointed globally renowned Clinical Research Organisation (CRO) Parexel to conduct and manage the Phase IIb/III European trial. Parexel is currently finalising site evaluations to select the sites (>30) in approximately nine European countries. Patient recruitment into the Phase IIb/III European trial will begin once requisite clinical trial application approvals are received for each jurisdiction. Preparations of the clinical trial applications for submission to the national competent authorities are progressing as per the timelines noted in the investor presentation.

Professor Thomas Voit MD (Director of NIHR GOSH UCL Biomedical Research Centre, UK) will be the Coordinating Principal Investigator of the trial. Dr Voit said of the PDCO outcome and the Company’s clinical plans for ATL1102 in DMD “Following on from the positive results of the Phase II clinical trial and the PDCO’s agreement on the upcoming Phase IIb/III study design for non-ambulant boys with Duchenne, it is very pleasing to be leading this international multi-centre pivotal clinical trial with ATL1102, potentially providing an alternative beyond current therapeutic options for the treatment of a significant proportion of patients more advanced with DMD.

Placement

The Placement was conducted at A$0.24 per New Share, which represents a 18.6% discount to the last closing price of ANP shares on the ASX on Wednesday 27 October 2021 of A$0.295 per share, a 13.6% discount to the fifteen-day VWAP and a 4.9% discount to the thirty-day VWAP (up to and including Wednesday 27 October 2021).

The New Shares issued under the Placement will rank equally with existing ANP fully paid ordinary shares on issue. ANP will issue the New Shares without shareholder approval in accordance with its existing placement capacity under ASX Listing Rule 7.1. Subject to shareholder approval at the Company’s AGM in December, placees will also be offered New Options as described below.

The Joint Lead Managers to the Placement are Morgans Corporate Limited (“Morgans”) (ABN 32 010539 607) and Wilsons Corporate Finance Limited (ABN 65 057 547 323) (“Wilsons”). XEC Partners Pty Ltd (“XEC”) acted as Corporate Adviser to the Company.

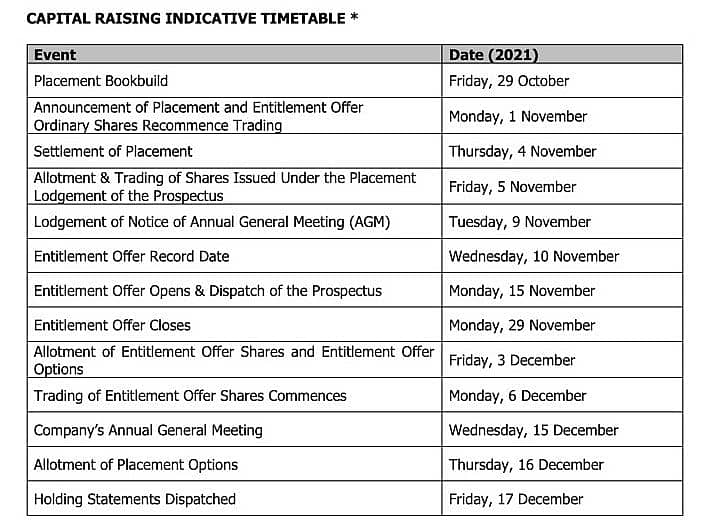

Settlement of the New Shares issued under the Placement is expected to occur on Thursday, 4 November 2021, with allotment and trading of the New Shares issued under the Placement scheduled for Friday, 5 November 2021.

Entitlement Offer

Following completion of the Placement, ANP will offer eligible shareholders the opportunity to acquire new shares via a non-underwritten 1 for 9.4 non-renounceable entitlement offer to raise approximately $16.8 million (“Entitlement Offer”).

The Offer price under the Entitlement Offer will be $0.24, being the same price as the Placement. Eligible Shareholders will be able to apply for shortfall shares under the Entitlement Offer.

Shares issued under the Placement will be cum-entitlement and will be eligible to participate in the Entitlement Offer.

The New Shares issued under the Entitlement Offer will rank equally with existing ANP fully paid ordinary shares on issue. Participants in the Placement and the Entitlement Offer will also be offered one free attaching unlisted option, each exercisable at A$0.48 (New Options), for every two New Shares subscribed for under the Placement and Entitlement Offer.

The New Options will expire on the earlier of:

• 20 December 2024; or

• 20 ASX business days after the Acceleration Trigger Date (Expiry Date)

Acceleration Trigger Date means the date on which the ATL1102 Phase IIb in DMD futility analysis results are announced to the ASX.

The full terms of the New Options will be set out in the Entitlement Offer Prospectus, which is expected to be lodged on the ASX on Friday, 5 November 2021.

Use Of Funds

The Company intends to use the net proceeds from the Placement & Entitlement Offer to fund:

• The Phase IIb/III DMD clinical trial progression;

• Initiation costs for an open label extension study;

• Drug manufacturing costs;

• Ongoing progression of R&D programs; and

• Additional working capital for the Company.

Funds raised via the Placement ($20.0M) and the Entitlement Offer ($16.8M if fully subscribed), are intended to be used to fund the Phase IIb/III clinical trial through to futility analysis expected to be completed mid-CY2023.

The 1:2 free-attaching options issued to participants of the Placement and Entitlement Offer, if fully exercised, will raise a further ($36.8M) to fund the clinical program through to Phase IIb/III trial results in mid-2024 whilst also funding the Open Label Extension Study to the same point.

Additional details are outlined in the investor presentation lodged today with the ASX.

Mark Diamond, ANP’s Managing Director said, “We are both pleased and extremely proud to have received this positive Opinion from PDCO on our PIP for ATL1102 in DMD which provides us with great confidence to undertake our Phase IIb/III trial in DMD in a manner consistent with the expectations of the regulator and which if successfully completed, could bring us an approval to market ATL1102 for the treatment of DMD in Europe, the world’s second largest pharmaceutical market.

The achievement of this major clinical development milestone has allowed us to move forward with the successful financing also announced today. The capital raising itself represents a pivotal moment in the history of the Company in providing a potential funding pathway for the conduct of the Phase IIb/III clinical trial through to trial results and in doing so gets us closer to bringing a much-needed therapy to patients in desperate need of better treatments. Accordingly, we would like to thank our existing shareholders and welcome all new investors who participated in the placement for supporting our development efforts.

With only a small number of ASX listed companies having made the journey into Phase III clinical development we know that we are in rarified pharmaceutical company. We appreciate the challenges that may lay ahead, though our highly experienced board and management team are very excited and energized to be embarking on this final stage of clinical development for treatment of non-ambulant DMD, a momentous occasion in the history of ANP, and we hope also in the lives of boys with DMD.”

“This key milestone in ANP’s journey has been achieved through the hard work of the management team, the patients and investigators of our prior studies and the commitment of our shareholders”, said Dr Charmaine Gittleson, ANP Board chair. “Now is the start of a particularly exciting time in a drug’s development as we are getting closer to realizing ATL1102’s potential to significantly improve the lives of boys with Duchennes and their families. We are fortunate to have our board member Dr. Gil Price, contributing to the Duchenne Guidance document update, as part of his role on the Parent Project Muscular Dystrophy Pharmaceutical Advisory Board.” Dr Price has noted that, “ATL1102 is uniquely placed with its mechanism of action addressing underlying inflammation which potentially worsens the fibrosis associated with DMD progression. Even with disease modifying strategies including exon-skipping and gene therapy, the inflammation is always there, thus the role for a safe effective product such as ATL1102 will always be there.”

*These dates are indicative only and are subject to change. ANP, reserves the right, subject to the Corporations Act 2001 (Cth) and the ASX Listing Rules, to amend this indicative timetable. In particular, ANP reserves the right to extend the Closing Date, accept late applications under the Entitlement Offer (either generally or in particular cases), and to withdraw or vary the Entitlement Offer without prior notice. Any extension of the Closing Date will have a consequential effect on the date for the allotment and issue of New Shares.

Additional Information

Further details on the Company’s business, the Placement and the Entitlement Offer are set out in the investor presentation provided to the ASX today and are also available to eligible persons not in the United States at the Company’s website at www.antisense.com.au. The investor presentation contains important information including key risks relating to ANP and an investment in ANP shares. Any person considering an investment in ANP shares should read the investor presentation and seek their own independent advice before making any decision in this regard.

This announcement has been authorised for release by the Board.

For more information please contact:

Antisense Therapeutics

Mark Diamond

Managing Director

+61 (0)3 9827 8999

www.antisense.com.au

Investment Enquiries

Gennadi Koutchin

XEC Partners

gkoutchin@xecpartners.com.au

1300 932 037

About Antisense Therapeutics Limited (ASX:ANP | US OTC:ATHJY) is an Australian publicly listed biotechnology company, developing and commercializing antisense pharmaceuticals for large unmet markets in rare diseases. The products are in-licensed from Ionis Pharmaceuticals Inc. (NASDAQ: IONS), an established leader in antisense drug development. The Company is developing ATL1102, an antisense inhibitor of the CD49d receptor, for Duchenne muscular dystrophy (DMD) patients and recently reported highly promising Phase II trial results. ATL1102 has also successfully completed a Phase II efficacy and safety trial, significantly reducing the number of brain lesions in patients with relapsing-remitting multiple sclerosis (RRMS). The Company has a second drug, ATL1103 designed to block GHr production that successfully reduced blood IGF-I levels in Phase II clinical trials in patients with the growth disorder acromegaly.

About ATL1102 ATL1102 is an antisense inhibitor of CD49d, a subunit of VLA-4 (Very Late Antigen-4). Antisense inhibition of VLA-4 expression has demonstrated activity in a number of animal models of inflammatory disease including asthma and MS with the MS animal data having been published in a peer reviewed scientific journal. ATL1102 was shown to be highly effective in reducing MS lesions in a Phase IIa clinical trial in patients with RR MS. The ATL1102 Phase IIa clinical data has been published in the medical Journal Neurology (Limmroth, V. et al Neurology, 2014; 83(20): 1780-1788).

About DMD Duchenne Muscular Dystrophy (DMD) is an X-linked disease that affects 1 in 3600 to 6000 live male births (Bushby et al, 2010). DMD occurs as a result of mutations in the dystrophin gene which causes a substantial reduction in or absence of the dystrophin protein. Children with DMD have dystrophin deficient muscles and are susceptible to contraction induced injury to muscle that triggers the immune system which exacerbates muscle damage as summarized in a publication co-authored by the Director of the FDA CDER (Rosenberg et al, 2015).

Ongoing deterioration in muscle strength affects lower limbs leading to impaired mobility, and also affects upper limbs, leading to further loss of function and self-care ability. The need for wheelchair use can occur in early teenage years for patients on corticosteroids with a mean age of 13, with respiratory, cardiac, cognitive dysfunction also emerging. Patients with a greater number of immune T cells expressing high levels of CD49d have more severe and progressive disease and are non-ambulant by the age of 10 despite being on corticosteroid treatment (Pinto Mariz et al, 2015). With no intervention, the mean age of life is approximately 19 years. The management of the inflammation associated with DMD is currently addressed via the use of corticosteroids, however they are acknowledged as providing insufficient efficacy and are associated with significant side effects. As a consequence, there is an acknowledged high need for new therapeutic approaches for the treatment of inflammation associated with DMD.

Rosenberg AS, Puig M, Nagaraju K, et al. Immune-mediated pathology in Duchenne muscular dystrophy. Sci Transl Med 2015, 7: 299rv4.

Bushby et al for the DMD Care Consideration Working Group/ Diagnosis and management of Duchenne muscular dystrophy, part 1 Lancet Neurol. 2010 Jan;9(1):77-93 and part 2 Lancet Neurol. 2010 Feb;9(2):177-89 .

Pinto-Mariz F, Carvalho LR, Araújo AQC, et al. CD49d is a disease progression biomarker and a potential target for immunotherapy in Duchenne muscular dystrophy. Skeletal Muscle 2015, 5: 45-55.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES

This announcement was prepared for publication in Australia and may not be released or distributed in the United States. This announcement does not constitute an offer to sell, or the solicitation of an offer to buy, any securities in the United States or to persons acting for the account or benefit of persons in the United States. Any securities described in this announcement have not been registered under the U.S. Securities Act of 1933 (the “U.S. Securities Act”), or the securities laws of any state or other jurisdiction of the United States and accordingly, may not be offered or sold to persons in the United States or to persons who are acting for the account or benefit of persons in the United States, unless they have been registered under the U.S. Securities Act, or are offered and sold in a transaction exempt from, or not subject to, the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws.